Getting The Personal Loans Canada To Work

Getting The Personal Loans Canada To Work

Blog Article

Personal Loans Canada Things To Know Before You Get This

Table of ContentsThe Ultimate Guide To Personal Loans CanadaUnknown Facts About Personal Loans Canada4 Simple Techniques For Personal Loans CanadaThe Single Strategy To Use For Personal Loans Canada5 Simple Techniques For Personal Loans Canada

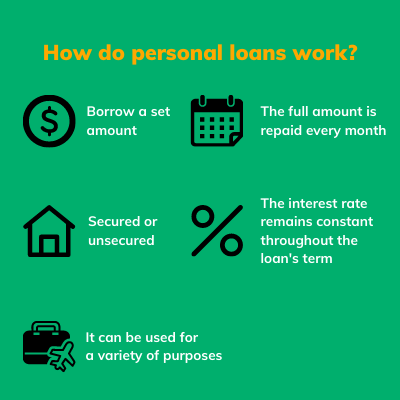

Let's dive into what an individual car loan in fact is (and what it's not), the reasons individuals use them, and exactly how you can cover those insane emergency costs without tackling the worry of financial obligation. A personal loan is a swelling amount of money you can borrow for. well, almost anything.That does not include obtaining $1,000 from your Uncle John to aid you spend for Christmas offers or letting your roommate spot you for a pair months' lease. You shouldn't do either of those things (for a number of reasons), but that's practically not an individual car loan. Individual finances are made via an actual financial institutionlike a financial institution, lending institution or online loan provider.

Allow's take an appearance at each so you can understand exactly just how they workand why you do not need one. Ever before.

Everything about Personal Loans Canada

Shocked? That's all right. Regardless of just how great your credit report is, you'll still have to pay interest on the majority of individual finances. There's constantly a cost to spend for obtaining money. Guaranteed personal fundings, on the other hand, have some type of collateral to "protect" the finance, like a boat, jewelry or RVjust among others.

You could additionally take out a safeguarded individual financing using your automobile as security. But that's a harmful action! You don't want your major mode of transportation to and from work getting repo'ed because you're still spending for in 2015's kitchen remodel. Depend on us, there's absolutely nothing protected regarding protected loans.

Just since the payments are predictable, it does not mean this is an excellent offer. Personal Loans Canada. Like we stated in the past, you're quite a lot assured to pay interest on an individual car loan. Simply do the mathematics: You'll wind up paying way more in the future by securing a financing than if you would certainly simply paid with cash money

The smart Trick of Personal Loans Canada That Nobody is Talking About

And you're the fish hanging on a line. An installation car loan is a personal finance you repay in taken care of installments in time (usually once a month) till it's paid completely - Personal Loans Canada. And do not miss this: You need to pay back the original funding amount before you can obtain anything else

Do not be misinterpreted: This isn't the same as a index credit card. With line of credits, you're paying rate of interest on the loaneven if you pay on schedule. This kind of loan is super difficult due to the fact that it makes you believe you're managing your financial obligation, when truly, it's handling you. Cash advance.

This set obtains us provoked up. Why? Because these services exploit individuals that can't pay their bills. And that's simply wrong. Technically, these are temporary fundings that provide you your income ahead of time. That may seem enthusiastic when you remain in an economic wreck and require some cash to cover your bills.

Examine This Report on Personal Loans Canada

Why? Due to the fact that points get actual messy real quickly when you miss out on a settlement. Those lenders will come after your pleasant grandma who guaranteed the lending for you. Oh, and you should never ever guarantee a finance for anyone else either! Not only might you get stuck with a lending that was never implied to be yours in the initial place, yet it'll destroy the connection before you can say "compensate." Count on us, you do not intend to be on this hyperlink either side of this sticky scenario.

Yet all you're actually doing is using new debt to pay off old financial obligation (and extending your car loan term). That just means you'll be paying much more in time. Firms know that toowhich is exactly why many of them offer you combination finances. A lower rate of interest does not get you out of debtyou do.

And it starts with not obtaining anymore money. ever before. This is a great policy of thumb for any kind of economic purchase. Whether you're thinking about securing an individual funding to cover that kitchen remodel or your frustrating charge card expenses. do not. Obtaining financial website link obligation to pay for things isn't the way to go.

Rumored Buzz on Personal Loans Canada

The finest thing you can do for your economic future is obtain out of that buy-now-pay-later mindset and say no to those investing impulses. And if you're taking into consideration an individual financing to cover an emergency situation, we get it. However obtaining money to pay for an emergency just rises the tension and difficulty of the circumstance.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Report this page